We’ve rated Lemonade pet insurance on price, coverage, policy options, waiting periods, customer support, and more. Read our Lemonade pet insurance review to see how this company stacks up.

The Cats.com Standard – Rating Lemonade Pet Insurance On What Matters

We’ve rated the brand on six key criteria for quality. Here’s how it rates in each of these six crucial areas.

Ratings

- Price– 8/10

- Coverage– 9/10

- Policy Options– 9/10

- Waiting Periods– 10/10

- Customer Support– 7/10

Overall Score: 8.6/10

In total, we give Lemonade pet insurance a 43 out of 50 rating or 8.6 out of 10.

Pros Of Lemonade Pet Insurance:

- Fast claims processing through the Lemonade mobile app

- The company uses a business model designed to prevent an adversarial relationship between the insurer and the insured and is a certified b-corp (is a certified b-corp)

- Customizable coverage with preventive care plans and other optional add-ons available (such as vet visit fees and physical therapy)

- Preventative care for puppies and kittens available for pets under 2 years (covers spaying/neutering, microchipping and more)

- Discounts available for multi-policy pet parents

- Short 2-day waiting period for accidents and 14 days for illnesses

- Annual coverage limit up to $100,000 available

Cons Of Lemonade Pet Insurance:

- Customer service is only available by app or email; no phone support

- Alternative therapies aren’t included in standard coverage

- Coverage isn’t available in all US states

- Dental illnesses aren’t covered at the moment

Lemonade Pet Insurance Video Review

About Lemonade Pet Insurance

Founded in 2015, Lemonade is a young, ambitious, and fast-growing insurance company on a mission to “transform insurance from a necessary evil into a social good.” It’s perhaps best known for renter’s insurance, but the company has expanded to offer home, term life, car, and pet insurance.

Regardless of the type of insurance you’re buying, Lemonade’s main selling points are its speedy AI-driven quote and claims processing system, competitive pricing, and perhaps most importantly, the fact that the entire system is engineered to minimize the adversarial relationship most of us have with our insurance providers.

As part of their transparent earnings structure, Lemonade takes a 20% cut from your premiums and uses it to cover operating costs. The remaining 80% of the money from your premiums is reserved to fund claims. Then, instead of benefiting from denied claims, Lemonade donates any surplus money to charity at the end of the year.

That money doesn’t go to just any charity—Lemonade allows you to choose the organization to which you’d like that surplus money to go.

Of course, these types of charitable models are becoming increasingly popular, especially among millennial-oriented brands—in 2020, 70% of Lemonade’s customers were under 35—so no one would blame you for being skeptical.

But Lemonade seems to be making good on their promise. As of November 2021, they’ve donated over 2.2 million this year.

On the Lemonade blog, there’s an interesting article written by Daniel Schreiber, the CEO of Lemonade, explaining how this business model acts as a Ulysses contract—an anticipatory decision made to make it impossible to succumb to temptation. By tying their hands, so to speak, this model is supposed to prevent Lemonade from ever giving in to the same temptations that other insurance companies have.

Between its mission of social good, its status as a certified B-corp, and its use of AI to reduce inefficiencies and lower your claims process to seconds on average, Lemonade is undoubtedly a disruptive force in the insurance biz. But is it a good choice for your cat?

Let’s dive deeper and find out.

Coverage And Pricing

Signing up for Lemonade pet insurance is a simple, straightforward process. You simply visit the Lemonade website and provide some basic information about your cat as well as your contact information. Lemonade collects details about your pet’s age, breed, sex, and health history to customize your plan and provide an accurate quote.

The standard Lemonade pet health insurance plan covers diagnostics, procedures, and medications for unexpected accidents and illnesses. You can purchase supplemental coverage for vet visit fees, physical therapy, and preventive care for an additional cost.

Here’s a quick overview of what Lemonade’s standard accident and illness pet insurance covers:

- Bloodwork, urinalysis, and lab work

- X-rays, MRIs, CT scans, and ultrasounds

- Outpatient, specialty, and emergency care

- Hospitalization and surgery

- Injections and prescription medications

The standard Lemonade pet insurance plan is quoted with an 80% reimbursement rate, a $250 annual deductible, and a $20,000 annual coverage limit.

You can customize your Lemonade pet insurance policy to fit your budget. Choose from three reimbursement rates (70%, 80%, or 90%) and three annual deductibles ($100, $250, or $500). Lemonade offers an annual limit on claims between $5,000 and $100,000.

Monthly Lemonade pet insurance plans vary in price depending on your cat’s age and health status as well as your location. Monthly premiums start around $12 but can approach $50 per month in certain states with expanded coverage options selected.

To help make their plans even more affordable, Lemonade offers discounts for multiple pets, for paying your premium annually, and for existing customers who have Lemonade’s homeowners or renters insurance.

What About Exclusions And Waiting Periods?

Generally speaking, Lemonade’s standard pet insurance policies are fairly generous. You don’t have to purchase separate accidents and illness coverage, and they cover diagnostics, procedures, and medication for eligible events.

As is true for many pet insurance companies, Lemonade doesn’t cover vet exam fees in their standard plan (but there’s an option for an add-on for around $4 per month). Outpatient, specialty, and emergency care are covered. Neither does Lemonade cover alternative treatments like acupuncture, physical therapy, or chiropractic care unless you add it to your policy for a few dollars a month.

Lemonade is like most pet insurance plans in that they also don’t cover preventive care in their standard plan. This includes things like annual wellness exams, vaccines, and dental cleaning. You can, however, add coverage for an additional monthly cost.

This company doesn’t cover dental procedures (unless it’s related to an injury), but you can add routine dental cleanings with their Preventive+ package. Neither do they cover spaying and neutering procedures in pets over 2 years old.

Lemonade also offers an optional preventative care package designed for kittens under 2 years, which includes coverage for items like spaying and neutering, microchipping, additional vaccinations and more.

Waiting Periods

Pet insurance providers take steps to prevent fraud by making sure pet owners can’t purchase a policy knowing their pet needs treatment. Most companies require pet owners to complete a waiting period after the policy effective date before they can submit a claim.

Lemonade only requires a waiting period of two days for injuries and a 14-day waiting period for illnesses. As is true for most pet insurance companies, they require a longer 6-month waiting period for orthopedic (cruciate ligaments) injuries.

Pre-Existing Conditions

No pet insurance company covers pre-existing conditions, though some companies consider certain conditions curable and will provide coverage after a certain time period.

Here’s how Lemonade defines pre-existing conditions:

“A pre-existing condition refers to any kind of illness or health issue your pet developed before your waiting period was up on your insurer. It doesn’t mean pet insurance companies won’t insure your pet, it just means your plan won’t cover costs that directly relate to any ailment they had in their medical history before they signed up for a pet insurance policy.”

Pre-existing conditions are determined by your cat’s medical record. If you sign up for Lemonade pet insurance, you’ll need to have your vet send the company your pet’s medical records and have him seen by a veterinarian within 12 months of the policy’s start date.

What Do Customers Think Of Lemonade Pet Insurance?

Lemonade was founded in 2015 and currently has over 1 million customers, about 70% of which are under the age of 35. In terms of customer satisfaction, their renters’ insurance received J.D. Power’s highest rating in 2020, and the company has received positive reviews from Fortune Magazine, The Wall Street Journal, and Forbes.

Because Lemonade is still fairly young, we didn’t find a significant number of customer reviews online. At the time of review, Lemonade had 80 customer ratings on Consumer Affairs with a 4.5 out of 5-star rating overall.

Customers report quick claims processing and generous coverage, though there are some negative comments about waiting periods and pre-existing condition exclusions.

However, we weren’t able to identify any trends indicating problems—because of the ubiquity of denied coverage for pre-existing conditions and waiting periods, these types of complaints are common among all pet insurance providers.

Let’s take a look at what real Lemonade customers have to say about their pet insurance.

Positive Reviews

“Lemonade pet insurance really helped me avoid major financial problems once my cat got unexpectedly sick. Emergency fees and surgery costs were high and I found out that my cat should get the procedure immediately. Everything happened so fast and I found myself using up my savings/credit card to pay the upfront costs. Fortunately, I had some peace of mind because I had Lemonade cat insurance… Overall, the process was very straightforward. I am very thankful for Lemonade’s cat insurance services and their professional, courteous staff who I have had a great pleasure communicating with.” – Nicole of Davis, CA

“When I got Ludo at 8 weeks 1 day in December I had already reached out to Lemonade for insurance. They were very timely and thorough with their responses. They sent me info on exactly what kind of physical they needed. All went very smoothly and I was happy.” – Melody of Norwood, NY

Negative Reviews

“Poor customer service, agent was dismissive, rude and would not answer direct questions. Also, they expect you to jump through hoops to file a simple claim requiring you to upload a video of yourself explaining the claim and submit doctor’s notes, etc. Ridiculous! Canceled today prior to first 30 days and they refused to give me a refund of my $43.00 even though I didn’t use their service.” – Adria of Round Rock, TX

“Lemonade’s “pre-existing conditions” include items that are not considered to be conditions… FYI. My 3-month-old puppy had some dermatitis (inflammation of the skin) on his very first doctor’s visit, which was soon after we adopted him and got the policy. We were asked to keep an eye on it. Now they’re saying they won’t cover ANY dermatitis, which is the most generic issue that could have been written, at any point in his life. They also won’t cover ANYTHING that causes the dermatitis…. which could range from anything including sun allergies to eczema to shampoo to another dog’s saliva, etc. Any time he has inflammation of the skin, we can’t be expected to be covered.” – Karen of Austin, TX

Sample Lemonade Pet Insurance Plan

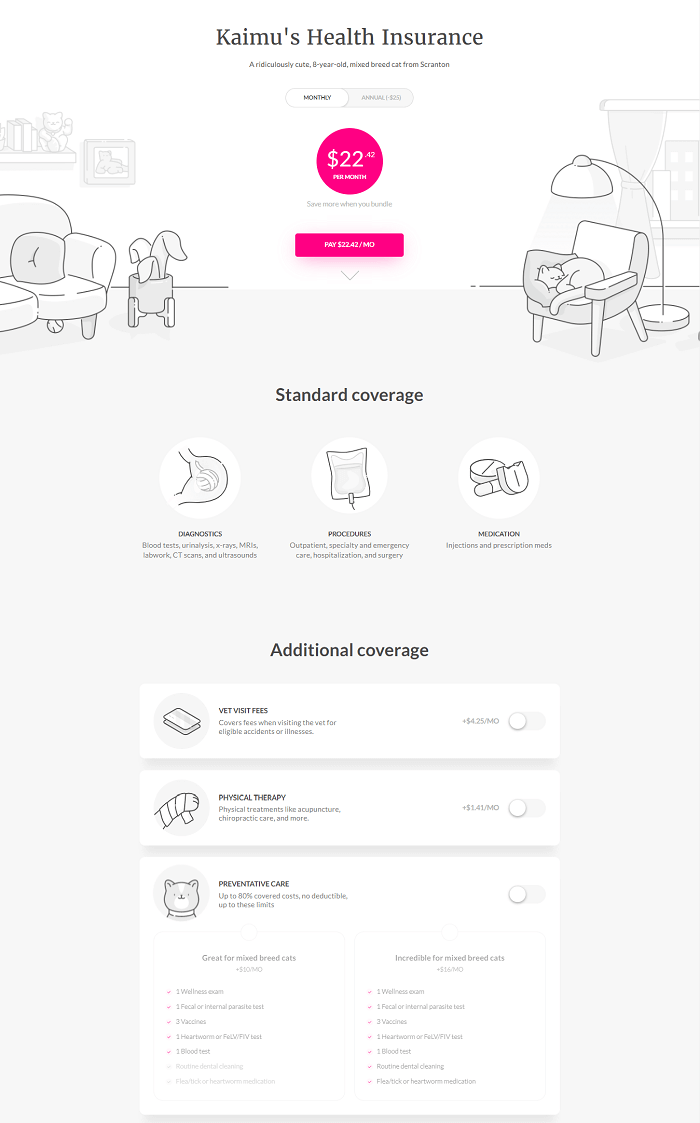

To give you an idea how much Lemonade pet insurance costs, we requested a quote using an 8-year-old, female, mixed breed cat in Pennsylvania with a history of dental issues.

Lemonade calculated a monthly premium of $22.42 and offered a $25 discount for paying annually. The standard plan came with an 80% reimbursement rate with a $250 annual deductible and a $20,000 annual claims limit.

Here’s a rundown of the pricing for this plan:

| Standard Coverage | |||

| Diagnostics | Procedures | Medication | |

| Additional Coverage | |||

| Vet Visit Fees | + $4.25/month | ||

| Physical Therapy | + $1.41/month | ||

| Preventive Care Options | |||

| + $10/month | + $16/month | ||

| 1 Wellness Exam

1 Fecal or Internal Parasite Test 3 Vaccines 1 Heartworm Test or FeLV/FIV Test 1 Blood Test |

1 Wellness Exam

1 Fecal or Internal Parasite Test 3 Vaccines 1 Heartworm Test or FeLV/FIV Test 1 Blood Test Routine Dental Cleaning Flea/Tick or Heartworm Medication |

||

Pros And Cons For Lemonade Pet Insurance

Most pet insurance providers offer similar products, but there are a few details that set Lemonade apart.

Enrollment is made easy through the Lemonade website and Lemonade app, though some customers dislike that claims can only be filed digitally, and customer service is only available by phone for emergencies related to car, home, and property.

To file a claim, you’ll need to submit documents related to your vet bill and record a video of you explaining the claim.

In terms of pricing, Lemonade makes it easy to customize your plan and offers a lower rate for mixed breeds. Instead of listing specific mixed breeds individually like many companies, they put mixed breeds into generic buckets by breed size. Unfortunately, they raise prices for long-haired breeds.

Generally speaking, Lemonade’s waiting periods are on par with other companies, though the 2-day waiting period for accident coverage is shorter than some.

Overall, Is Lemonade Pet Insurance Worth It?

Overall, if you’re going to purchase pet insurance, we think Lemonade is an excellent choice.

Their standard plan covers all of the basics for accidents and illnesses with optional preventive care coverage for pet parents who want it. The prices are competitive and you can customize your plan in terms of reimbursement rate, annual deductible, and annual coverage limits.

Just keep in mind that Lemonade insurance is only available online or through the mobile app, and you may not be able to access coverage in all 50 states. Be sure to check the site to make sure that it’s available in your state.

Click Here To Get A Quote On Lemonade Pet Insurance For Cats